UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

|

|

|

|

|

|

|

|

|

☐ Preliminary Proxy Statement

☐Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

Bank of Hawaii Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

|

|

|

|

|

|

Your VOTE is important!

Notice of 20222024

Annual Meeting of Shareholders

and Proxy Statement

Meeting Date: April 29, 202226, 2024

Bank of HawaiiHawai‘i Corporation

130 Merchant Street

Honolulu, HawaiiHawai‘i 96813

LETTER FROM OUR CHAIRMAN, CEO, AND PRESIDENT

March 18, 202215, 2024

Dear Shareholder:

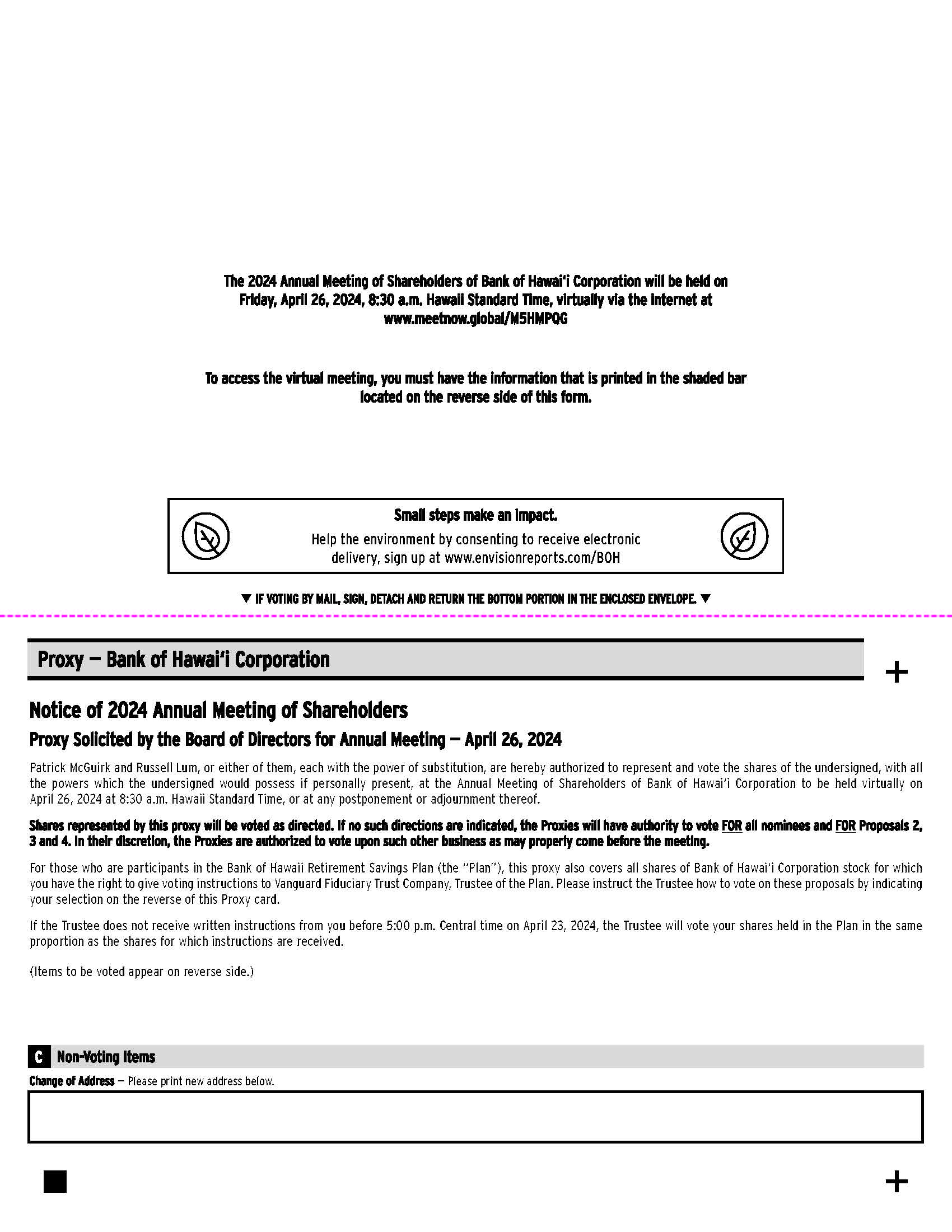

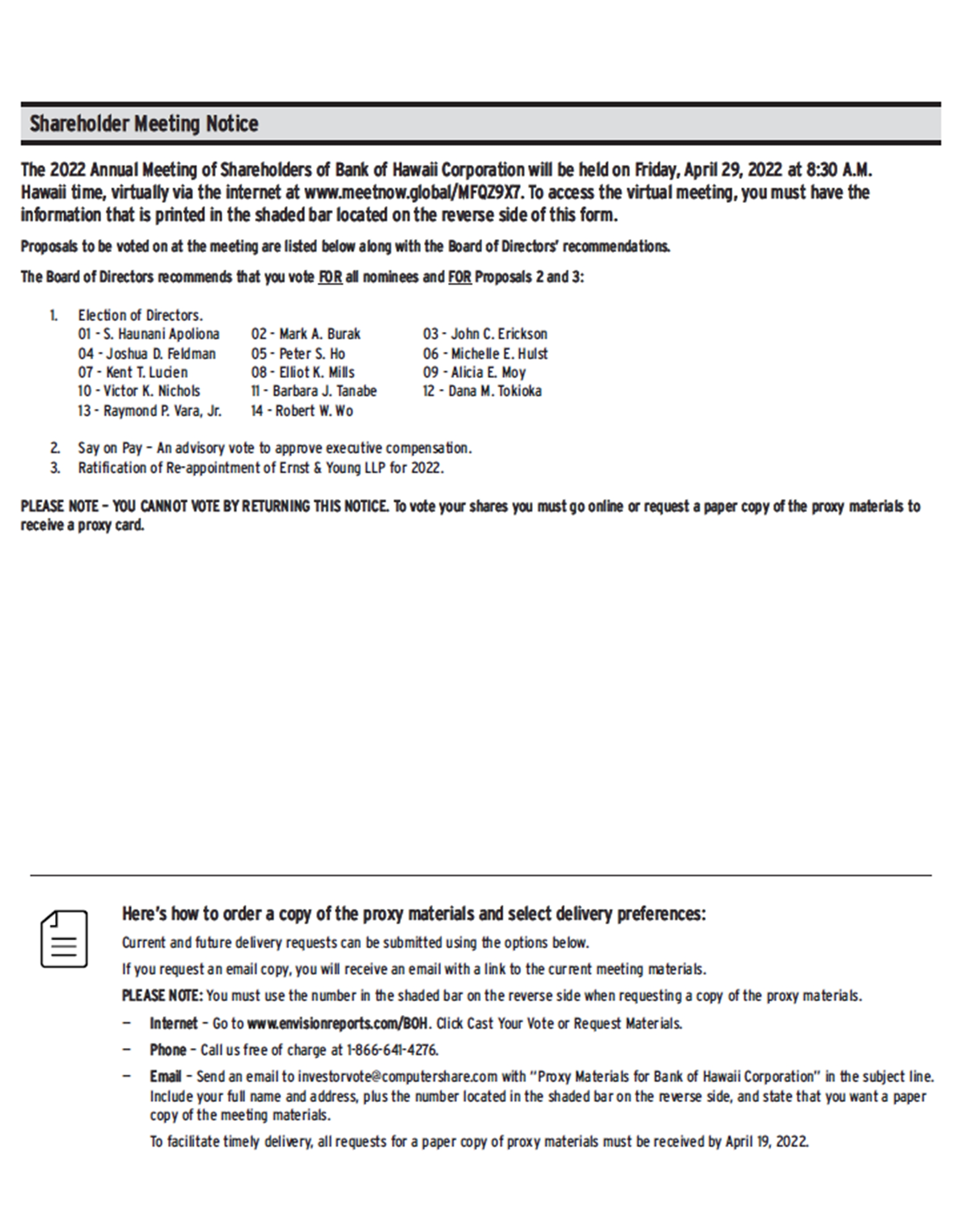

The 20222024 Annual Meeting of Shareholders of Bank of HawaiiHawai‘i Corporation will be held via live webcast on Friday, April 29, 2022,26, 2024, at 8:30 a.m. Hawaii Standard Time. Each shareholder will be asked to provide their control number when logging in to attend the virtual Annual Meeting. Shareholders who hold shares through an intermediary, such as a bank or broker, will also be able to use the control number provided by their bank or broker to attend and participate at the virtual Annual Meeting. More detailed instructions on how to attend and vote at the virtual Annual Meeting are found on pages 3 and 4.

The Notice of Meeting and Proxy Statement accompanying this letter describe the business we will consider and vote upon at the meeting. A report to shareholders on the affairs of Bank of HawaiiHawai‘i Corporation also will be given and shareholders will have the opportunity to ask about matters of interest concerning the Company through the virtual meeting platform during the virtual Annual Meeting.

For reasons explained in the accompanying Proxy Statement, the Board of Directors recommends that you vote FOR Proposal 1: Election of Directors, FOR Proposal 2: Advisory Vote on Executive Compensation, FOR Proposal 3: Approval of Bank of Hawai'i Corporation 2024 Stock and Incentive Plan, and FOR Proposal 3:4: Ratification of the Re-appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the 20222024 fiscal year.

Your vote is very important. Please complete, sign, date and return the enclosed proxy card and mail it promptly in the enclosed postage-paid return envelope, even if you plan to virtually attend the Annual Meeting. If you wish to do so, your proxy may be revoked at any time before voting occurs at the virtual Annual Meeting. You may also vote and change your vote at the virtual Annual Meeting.

On behalf of the Board of Directors, thank you for your cooperation and support.

Sincerely, | |

| |

Peter S. Ho Chairman of the Board, Chief Executive Officer, and President |

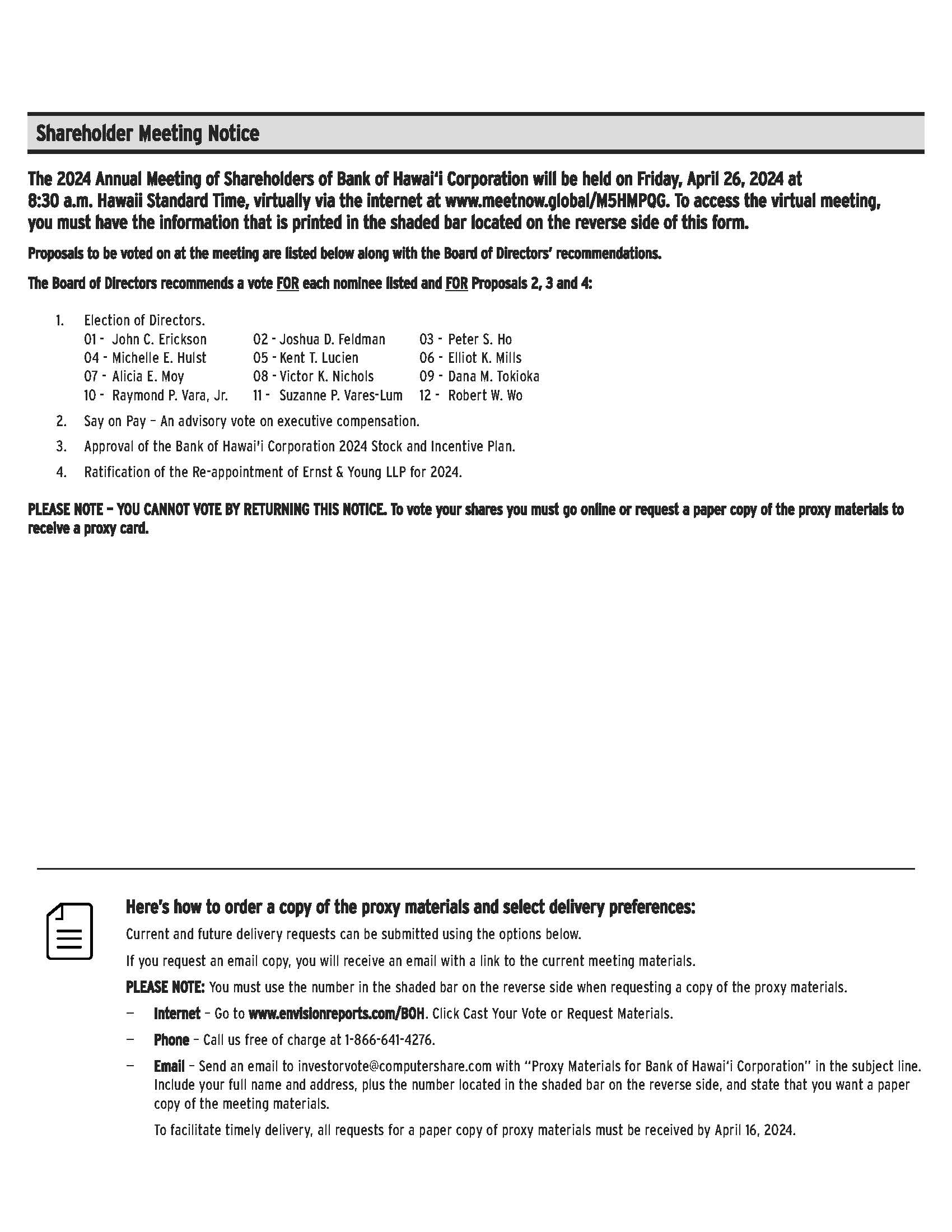

NOTICE OF 2022 2024ANNUAL MEETING OF SHAREHOLDERS

To be held April 29, 202226, 2024

To Our Shareholders:

The 20222024 Annual Meeting of Shareholders of Bank of HawaiiHawai‘i Corporation will be held via live webcast at www.meetnow.global/MFQZ9X7M5HMPQG on Friday, April 29, 2022,26, 2024, at 8:30 a.m. Hawaii Standard Time for the following purposes:

|

|

|

|

|

|

|

|

These items of business are more fully described in the proxy statement accompanying this Notice, which is being mailed to shareholders on or about March 18, 2022.15, 2024. Shareholders of record of Bank of HawaiiHawai‘i Corporation common stock (NYSE: BOH) at the close of business on February 28, 2022,29, 2024 are entitled to attend the meeting and vote on the business brought before it. A list of such shareholders shall be open to the examination of any shareholders upon request following the 20222024 Annual Meeting of Shareholders.

We look forward to connecting with you at the meeting. However, if you cannot attend the meeting, your shares may still be voted by telephone or via the Internet, or you may complete, sign, date, and return the enclosed proxy card in the enclosed postage-paid return envelope.

By Order of the Board of Directors, | |

| |

Patrick M. McGuirk | |

| |

Bank of |

Honolulu, HawaiiHawai‘i

March 18, 202215, 2024

Your Vote is Important! |

Please promptly sign and return the enclosed proxy card, or vote by telephone or on the Internet. Submitting your proxy by one of these methods will ensure your representation at the annual meeting regardless of whether you attend the meeting. |

Thank you for your participation! |

Important Notice Regarding the Availability of Proxy Materials

for the 20222024 Annual Meeting of Shareholders to be Held on April 29, 2022.26, 2024.

The Proxy Statement and the Bank of HawaiiHawai‘i Corporation 20212023 Annual Report

on Form 10-K to Shareholders for the year ended December 31, 2021,2023, are available at www.edocumentview.com/boh.

We encourage you to access and review all of the information in the proxy materials before voting.

BANK OF HAWAIIHAWAI‘I CORPORATION

PROXY STATEMENT

TABLE OF CONTENTS

Page | |

1 | |

3 | |

Questions and Answers About the Proxy Materials and the Annual Meeting | 3 |

6 | |

6 | |

16 | |

18 | |

| |

| |

34 | |

35 | |

35 | |

36 | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

66 | |

69 | |

| |

Proposal 3: Approval of Bank of Hawai‘i Corporation 2024 Stock and Incentive Plan | 71 |

| |

| |

| |

| |

| |

Appendix A: Bank of Hawai‘i Corporation 2024 Stock and Incentive Plan | 79 |

This summary contains highlights of information contained elsewhere in our proxy statement and does not contain all information to be considered. We encourage you to read the entire proxy statement before voting.

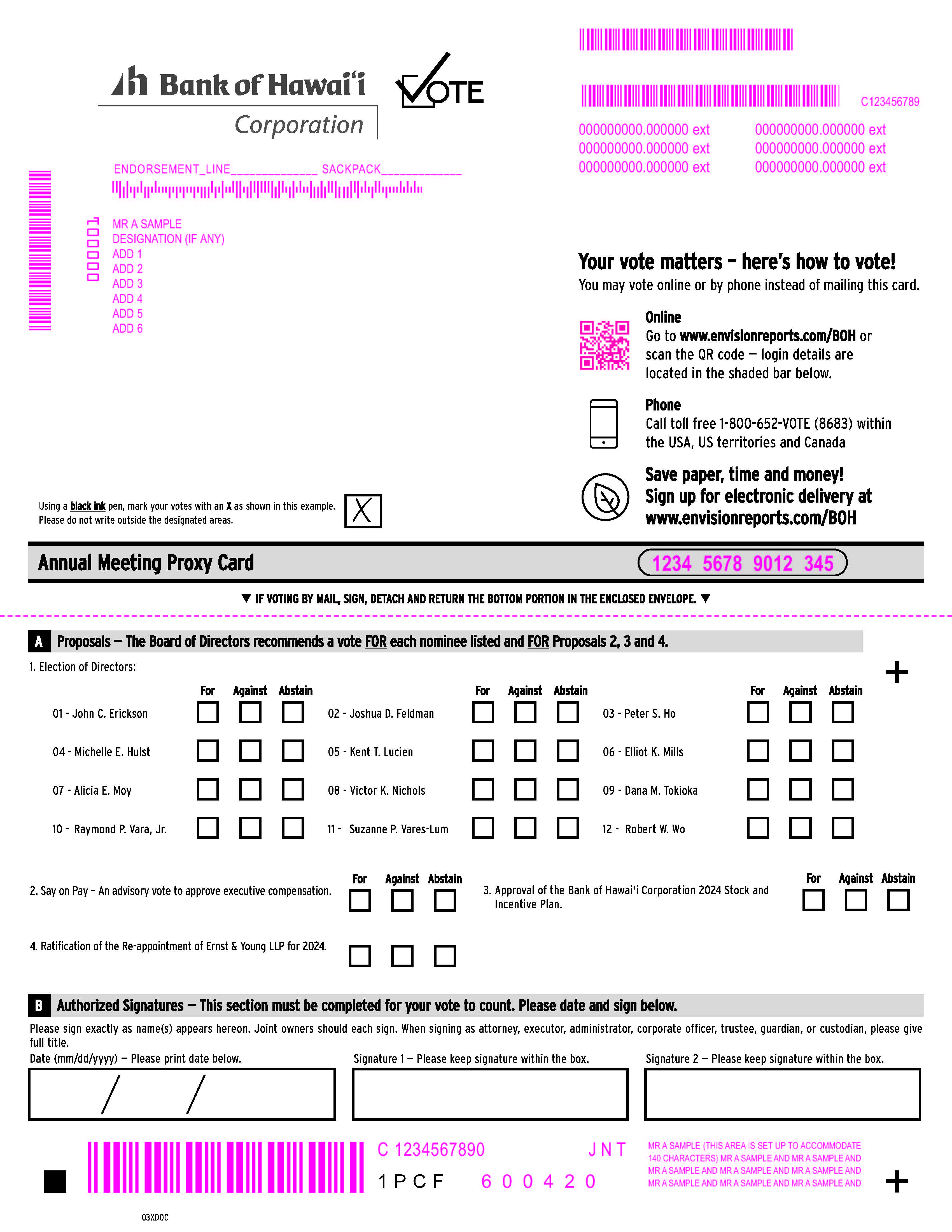

PROPOSALS FOR THE ANNUAL MEETING OF SHAREHOLDERS

Proposal | Proposal | Board Recommendation | Page | Proposal | Board Recommendation | Page |

1 | Election of Directors You are being asked to elect 14 directors. Each of the nominees standing for election will hold office until the 2023 Annual Meeting of Shareholders. The number of directors to be elected was fixed by the Board on October 22, 2021. | “FOR” | 6 | Election of Directors You are being asked to elect 12 directors. Each of the nominees standing for election will hold office until the 2025 Annual Meeting of Shareholders. The number of directors to be elected was fixed by the Board to be effective as of the date of the 2024 Annual Meeting of Shareholders. | “FOR” | 6 |

|

|

|

|

|

| |

2 | Advisory Vote on Executive Compensation You are being asked to vote, on an advisory (non-binding) basis, to approve the Company's executive compensation as disclosed in this proxy statement. | “FOR” | 35 | Advisory Vote on Executive Compensation You are being asked to vote, on an advisory (non-binding) basis, to approve the Company’s executive compensation as disclosed in this proxy statement. | “FOR” | 35 |

|

|

|

|

|

| |

3 | Ratification of the Re-Appointment of Ernst & Young LLP You are being asked to ratify, on an advisory (non-binding) basis, the re-appointment of Ernst & Young LLP as the Company's independent registered public accounting firm for fiscal year 2022. | “FOR” | 67 | Approval of Bank of Hawai‘i Corporation 2024 Stock and Incentive Plan You are being asked to vote to approve the Company’s 2024 Stock and Incentive Plan | “FOR” | 71 |

|

|

|

|

|

| |

4 | Ratification of the Re-Appointment of Ernst & Young LLP You are being asked to ratify, on an advisory (non-binding) basis, the re-appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for fiscal year 2024. | “FOR” | 76 | |||

|

|

| ||||

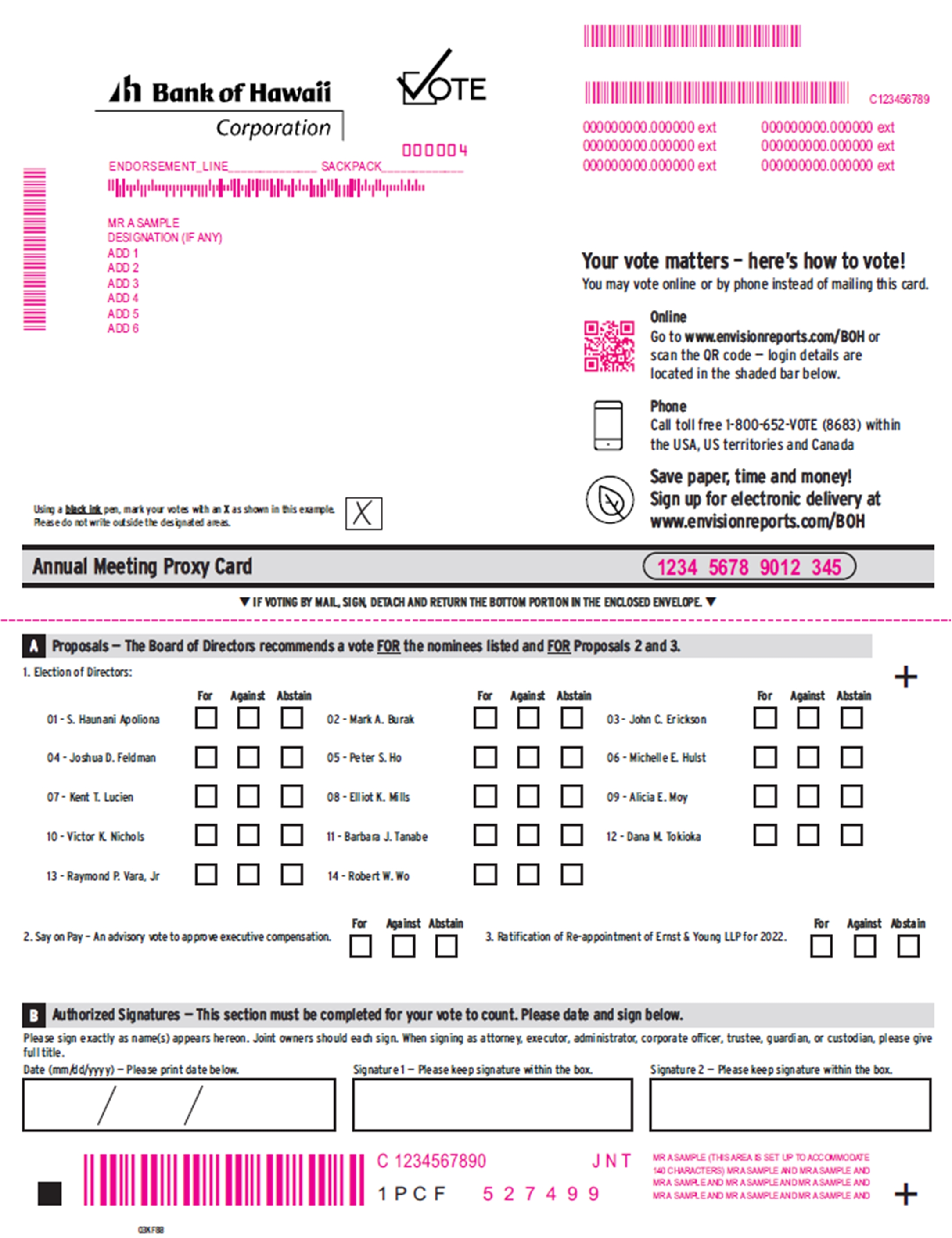

VOTING YOUR SHARES

You may vote if you are a shareholder of record as of the close of business on February 28, 2022.29, 2024. Each share of common stock is entitled to one vote. Shares of Series A Preferred Stock generally isare not entitled to vote. On the Record Date,February 29, 2024 (the “Record Date”), there were 40,391,18339,771,110 shares of common stock issued and outstanding. All votes are confidential.

| Online Registered holders can go to www.envisionreports.com/boh and follow the instructions. For shares held in street name, please see the instruction card included by your broker or nominee. |

| By Telephone If you live in the United States, you may submit your proxy by following the “Vote by Telephone” instruction on the proxy card. For shares held in street name, please see the instruction card included by your broker or nominee. |

| By Mail Complete, sign, and date the proxy card and return it in the envelope that was provided in the proxy statement package. For shares held in street name, please see the instruction card included by your broker or nominee. |

| Virtual Attendance via Webcast Register with your control number found on your proxy card, notice, or voting instruction form provided by your bank or broker and attend our virtual annual meeting. More detailed instructions on how to attend and vote are found on pages 3 and 4. |

Even if you plan to attend the Annual Meeting of Shareholders, we encourage all shareholders to vote in advance of the meeting.

1

HIGHLIGHTS

Bank of Hawaii Corporation (the(“Bank of Hawai‘i Corporation” or the “Company”) is an independent regional financial services company. The Company’s principal subsidiary, Bank of Hawaii (the(“Bank of Hawai‘i” or the “Bank”), was founded in 1897 and provides a broad range of financial products and services to businesses, consumers and governments in HawaiiHawai‘i and the West Pacific.

Bank of HawaiiHawai‘i Corporation is committed to meeting high standards of ethical behavior, corporate governance, and business conduct. The first two columns in the table below summarize the Company'sCompany’s governance and compensation practices, demonstrating what we do to drive performance and manage risk and is current through March 1, 2022.2024. The third column highlights the Company'sCompany’s business performance during 2021.2023.

Corporate Governance | Compensation Program Best Practices | Business Performance | |||

• Annual election of directors • Majority voting in director elections with a plurality carve-out in the case of contested elections and a director resignation policy • Independent directors comprise • 40% of directors are women and • Ongoing director refreshment with 6 new directors added in the past 5 years • Regular executive sessions of the Board without management present • Directors actively participate in continuing education programs • All directors attended at least 75% of the • Annual Say-on-Pay vote • Robust shareholder engagement process • Effective whistleblower policy and program • Annual Board and Committee self-evaluations • No poison pill | • Pay for performance by tying a substantial portion of executive compensation to performance goals • Significant portion of compensation is variable and performance-based • Significant stock ownership requirements (5x base salary for CEO, 2x for other NEOs) • No employment or severance agreements with NEOs • Anti-hedging and anti-pledging stock policies • Regularly conduct assessments to identify and mitigate risk in compensation programs • Evaluate executive compensation data and practices of our peer group companies as selected annually by the committee with guidance from the independent compensation consultant • Double-trigger change-in-control provisions • Independent compensation consultant • Formalized clawback policy • No tax gross-ups • No excessive perquisites • No repricing of equity incentive awards | • Diluted earnings per common share for the full year of $4.14 • Loans increased 2.1% •

Asset quality, liquidity, and capital all remain strong • Rated • Ranked Number 4

• Ranked Number 24 among the “World’s Most Trustworthy Companies” in the

only Hawai‘i bank listed. • Named Hawai‘i’s Best Bank by the readers of the Honolulu Star-Advertiser (13th consecutive year), Hawaii Tribune-Herald (8th consecutive year), West Hawaii Today • Named a top 3 finalist in the inaugural National Customer Obsessed Enterprise Award from global research firm Forrester. |

See “Corporate Governance”“Sound Environmental, Social, and Governance Leadership” starting on page 18, “Compensation Discussion and Analysis” starting on page 36, and “Business and Performance Overview” starting on page 40.41.

2

PROXY STATEMENTSTATEMENT

The Board of Directors (the “Board”) of Bank of HawaiiHawai‘i Corporation is soliciting the enclosed proxy for the Company's 2022Company’s 2024 Annual Meeting of Shareholders (the “Annual Meeting”). The proxy statement, proxy card, and the Company'sCompany’s Annual Report to Shareholders and Annual Report on Form 10-K are being distributed to the Company'sCompany’s shareholders on or about March 18, 2022.15, 2024.

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING

Q: | What is a proxy? |

| ||

A: | A proxy is your legal designation of another person to vote the shares you own. That other person that you designate is called a proxy and is required to vote your shares in the manner you instruct. If you designate someone as your proxy in a written document, that document also is called a proxy or a proxy card. If you vote by phone or via the Internet, you will have designated Patrick M. McGuirk and/or Russell Lum to act as your proxy to vote your shares at the Annual Meeting in the manner you direct. The Company is paying the costs of the solicitation of proxies. The Company has retained Georgeson LLC to assist in the distribution of proxy materials and the solicitation of proxies from individual shareholders as well as brokerage firms, fiduciaries, custodians, and other similar organizations representing beneficial owners of shares for the Annual Meeting. We have agreed to pay Georgeson a fee of approximately $12,750 plus variable amounts for additional proxy solicitation services and out-of-pocket expenses. In addition to solicitations by mail, the proxy solicitor and the Company’s nominees, officers, and employees, without additional compensation, may solicit proxies on the Company’s behalf in person, by phone, or by electronic communication. |

| ||

Q: | How many shares must be present to hold the |

| ||

A: | The holders of at least one-third of the Company’s outstanding common stock on the Record Date entitled to vote at the |

| ||

Q: | Why did I receive a one-page notice (the “Notice”) in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials? |

| ||

A: | The rules and regulations of the Securities and Exchange Commission (the “SEC”) allow companies to furnish proxy materials by providing access to such documents on the Internet instead of mailing a printed copy of proxy materials to each shareholder of record. Shareholders who previously requested to receive printed copies of proxy materials by mail will continue to receive them by mail. Shareholders who have not previously indicated a preference for printed copies of proxy materials are receiving the Notice. The Notice provides instructions on how to access and review all of the proxy materials and how to submit your proxy via the Internet. If you would like to receive a printed or e-mail copy of the proxy materials, please follow the instructions for requesting such materials in the Notice. |

| ||

Q: | What are the voting procedures? |

| ||

A: | Under our Certificate of Incorporation, Directors are elected annually by majority of votes cast (Proposal 1). This means that a director is elected if the number of votes cast for the nominee exceeds the number of votes cast against the nominee. In the event of a contested election, the election is determined by plurality vote. This means that the nominees who receive the highest number of affirmative votes are elected. Abstentions and broker non-votes do not affect the outcome of a plurality vote. | |

The advisory vote on executive compensation (Proposal 2), the approval of the Company’s 2024 Stock and Incentive Plan (Proposal 3) and the advisory vote on the ratification of the reappointment of our independent registered public accounting firm (Proposal 4) are also decided by a majority of votes cast. For Proposals 1, 2 and 3, broker non-votes will be treated as not entitled to vote and will not affect the outcome. For Proposal 4, your broker, bank, trustee, or other nominee may exercise its discretion and vote. Abstentions will have the same effect as votes cast against the proposal. | ||

Holders of our common stock are entitled to one vote per share of common stock held on the Record Date. The outstanding shares of Series A Preferred Stock are not entitled to any voting rights for any current proposal. |

3

The advisory vote on executive compensation (Proposal 2) and the advisory vote on the ratification

Holders of our common stock are entitled to one vote per share of common stock held on the Record Date. The outstanding shares of Series A Preferred Stock are not entitled to any voting rights for any current proposal.

Q: | May I change my vote? | ||

| |||

A: | Yes. You may change your proxy instructions any time before the vote at the Annual Meeting. Attendance at the virtual Annual Meeting will not cause your previously granted proxy to be revoked unless you also vote at the meeting. | ||

3

| |||

Q: | What is a broker non-vote? | ||

| |||

A: | The New York Stock Exchange (“NYSE”) allows its member-brokers to vote shares held by them for their customers on matters the NYSE determines are routine, even though the brokers have not received voting instructions from their customers. Of the proposals anticipated to be brought at the | ||

| |||

Q: | Why are we holding a virtual Annual Meeting? | ||

|

| ||

A: | The Annual Meeting | ||

| |||

Q: | How can I attend the Annual | ||

The online meeting will begin promptly at 8:30 a.m. Hawaii Standard Time. We encourage you to access the virtual meeting website prior to the start time to leave ample time for check-in. Please follow the instructions as outlined in this proxy statement.

If you hold your shares through a bank or broker as a beneficial shareholder, and want to attend the Annual Meeting online by webcast (with the ability to ask a question and/or vote, if you choose to do so) you have two options:

| |||

The online meeting will begin promptly at 8:30 a.m. Hawaii Standard Time. We encourage you to access the virtual meeting website prior to the start time to leave ample time for check-in. Please follow the instructions as outlined in this proxy statement. | |||

If you hold your shares through a bank or broker as a beneficial shareholder, and want to attend the Annual Meeting online by webcast (with the ability to ask a question and/or vote, if you choose to do so) you have two options: | |||

1) Registration in Advance of the Annual Meeting | |||

Submit proof of your proxy power (“Legal Proxy”) from your broker or bank reflecting your Bank of Hawaii Corporation holdings along with your name and email address to Computershare. Requests for registration must be labeled “Legal Proxy” and be received no later than 5:00 p.m. Eastern Time, on April 26, 2022. You will receive a confirmation of your registration by email after Computershare receives your registration materials. Requests for registration should be directed to Computershare at the following:

| |||

Submit proof of your proxy power (“Legal Proxy”) from your broker or bank reflecting your Bank of Hawai‘i Corporation holdings along with your name and email address to Computershare. Requests for registration must be labeled “Legal Proxy” and be received no later than 5:00 p.m. Eastern Time, on April 23, 2024. You will receive a confirmation of your registration by email after Computershare receives your registration materials. Requests for registration should be directed to Computershare at the following: | |||

By email: | Forward the email from your broker granting you a Legal Proxy, or attach an image of your Legal Proxy, to | ||

legalproxy@computershare.com | |||

| By mail: | Computershare | |

Bank of | |||

P.O. Box 43001 | |||

Providence, RI 02940-3001 | |||

4

4

For the 2022 proxy season, an industry solution has been agreed upon to allow beneficial shareholders to register online at the Annual Meeting to attend, ask questions and vote. We expect that the vast majority of beneficial shareholders will be able to fully participate using the control number received with their voting instruction form. Please note, however, that this option is intended to be provided as a convenience to beneficial shareholders only, and there is no guarantee this option will be available for every type of beneficial shareholder voting control number. The inability to provide this option to any or all beneficial shareholders shall in no way impact the validity of the Annual Meeting. Beneficial shareholders may choose the Register in Advance of the Annual Meeting option above, if they prefer to use this traditional, paper-based option. You may vote your shares as usual via ProxyVote.com.

In any event, please go to www.meetnow.global/MFQZ9X7 for more information on the available options and registration instructions.

| ||

For the 2024 proxy season, an industry solution has been agreed upon to allow beneficial shareholders to register online at the Annual Meeting to attend, ask questions and vote. We expect that the vast majority of beneficial shareholders will be able to fully participate using the control number received with their voting instruction form. Please note, however, that this option is intended to be provided as a convenience to beneficial shareholders only, and there is no guarantee this option will be available for every type of beneficial shareholder voting control number. The inability to provide this option to any or all beneficial shareholders shall in no way impact the validity of the Annual Meeting. Beneficial shareholders may choose the Register in Advance of the Annual Meeting option above, if they prefer to use this traditional, paper-based option. You may vote your shares as usual via ProxyVote.com. | ||

In any event, please go to www.meetnow.global/M5HMPQG for more information on the available options and registration instructions. | ||

Q: | What if I have trouble accessing the Annual Meeting virtually? |

| ||

A: | The virtual meeting platform is fully supported across browsers |

Computershare

1-888-724-2416

1-781-575-2748

Hours: 8:30 a.m. - 6:00 p.m. Eastern Time

| ||

Computershare | ||

1-888-724-2416 | ||

1-781-575-2748 | ||

Hours: 8:30 a.m. - 6:00 p.m. Eastern Time | ||

Q: | May I propose actions for consideration at next |

| ||

A: | Yes. You may submit proposals for consideration at the |

Proposals To Be Included In The Proxy Statement and Voted On At The Meeting. Proposals that shareholders wish to have included in the proxy statement for the 2023 Annual Meeting of Shareholders must be made in accordance with SEC Rule 14a-8. Proposals must be received by the Company's Corporate Secretary on or before November 18, 2022, at the above address.

Proposals To Be Voted On At The Meeting Only. Under Section 1.12 of the Company's Bylaws, for a shareholder to bring a proposal before the 2023 Annual Meeting, the Company must receive the written proposal not later than 80 days nor earlier than 90 days before the first anniversary of the 2022 annual meeting; in other words, not earlier than January 29, 2023, and no later than February 8, 2023. The proposal also must contain the information required in the Bylaws. If you wish to make one or more nominations for election to the Board, the required information includes, among other things, the written consent of such individual to serve as director and (i) the name, age, business address and, if known, residence address of each nominee, (ii) the principal occupation or employment of each nominee, and (iii) the number of shares of Bank of Hawaii Corporation common stock each nominee beneficially owns. These advance notice provisions are separate from the requirements a shareholder must meet to have a proposal included in the proxy statement under SEC rules. By complying with these provisions, a shareholder may present a proposal in person at the meeting, but will not be entitled to have the proposal included in the Company's proxy statement unless they comply with the requirements described in the preceding paragraph. Persons holding proxies solicited by the Board may exercise discretionary authority to vote against such proposals.

| ||

Proposals To Be Included In The Proxy Statement and Voted On At The Meeting. Proposals that shareholders wish to have included in the proxy statement for the 2025 Annual Meeting of Shareholders must be made in accordance with SEC Rule 14a-8. Proposals must be received by the Company’s Corporate Secretary on or before November 17, 2024, at the above address. | ||

Proposals To Be Voted On At The Meeting Only. Under Section 1.12 of the Company’s Bylaws, for a shareholder to bring a proposal before the 2025 Annual Meeting, the Company must receive the written proposal not later than 80 days nor earlier than 90 days before the first anniversary of the 2024 annual meeting; in other words, not earlier than January 26, 2025, and no later than February 5, 2025. The proposal also must contain the information required in the Bylaws. If you wish to make one or more nominations for election to the Board, the required information includes, among other things, the written consent of such individual to serve as director and (i) the name, age, business address and, if known, residence address of each nominee, (ii) the principal occupation or employment of each nominee, and (iii) the number of shares of Bank of Hawai‘i Corporation common stock each nominee beneficially owns. These advance notice provisions are separate from the requirements a shareholder must meet to have a proposal included in the proxy statement under SEC rules. By complying with these provisions, a shareholder may present a proposal in person at the meeting, but will not be entitled to have the proposal included in the Company’s proxy statement unless they comply with the requirements described in the preceding paragraph. Persons holding proxies solicited by the Board may exercise discretionary authority to vote against such proposals. In addition to satisfying the foregoing requirements under the Company’s Bylaws, to comply with the “universal proxy rules”, shareholders who intend to solicit proxies in support of director nominees at the 2025 Annual Meeting must include the additional information required by SEC Rule 14a-19(b) including a statement that they intend to solicit 67% of outstanding voting shares. | ||

Q: | Where can I find the voting results of the Annual Meeting? |

| ||

A: | We plan to announce preliminary voting results at the Annual Meeting. We will publish final voting results in a report on Form 8-K within four business days of the Annual Meeting. |

| ||

Q: | What happens if the meeting is postponed or adjourned? |

| ||

A: | Your proxy will remain valid and may be voted at the postponed or adjourned meeting. You will still be able to change or revoke your proxy until it is voted. |

5

PROPOSAL 1: ELECTION OF DIRECTORS

The Company’s Certificate of Incorporation requires that the Company’s Board consist of not fewer than three directors and not more than 15 directors, with the exact number to be determined by the Board. On October 22, 2021, theThe Board fixed the number of directors for election at the annual meeting at 14.to be 12. Each of the 1412 directors listed below has been nominated for a one-year term to serve until the 20232025 Annual Meeting of Shareholders and until his or her successor is elected and qualifiedor until the director’s earlier resignation, removal, death or disqualification. In the event that any or all of the director nominees are unable to stand for election as director, the Board, upon the recommendation of the Nominating & Corporate Governance Committee, may select different nominees for election as directors.

Certain information with respect to each of the nominees is set forth below, including his or her principal occupation, qualifications, and directorships during the past five years. Each nominee has consented to serve and all nominees are currently serving on the Company’s Board. The nominees were each recommended to the Board by the Company’s Nominating & Corporate Governance Committee whose goal is to assemble a board that operates cohesively, encourages candid communication and discussion, and focuses on activities that help the Company create sustainable long-term growth and maximize shareholder value. The Nominating & Corporate Governance Committee also looks at the individual strengths of directors, their ability to contribute to the Board, and whether their skills and experience complement those of the other directors. A more detailed discussion on the nomination process and the criteria the Nominating & Corporate Governance Committee considers in their evaluation of director candidates is found in the Commitment to Effective Corporate Governance section which begins on page 18.

The Board of Directors recommends a vote “FOR” each of the nominees.

Name | Age |

|

| Year First Elected as Director |

| Independent |

| Other Public Directorships Held in Last 5 Years |

| Committee Membership | Age |

| Year First |

| Independent |

| Other Public |

| Committee Membership | |

S. Haunani Apoliona |

| 72 |

|

| 2004 |

| Yes |

| None |

| BPC, FIMC, NCGC | |||||||||

Mark A. Burak |

| 73 |

|

| 2009 |

| Yes |

| None |

| ARC, NCGC | |||||||||

John C. Erickson |

| 60 |

|

| 2019 |

| Yes |

| 2 |

| ARC, NCGC | 62 |

| 2019 |

| Yes |

| 2 |

| ARC, BSC, NCGC |

Joshua D. Feldman |

| 49 |

|

| 2019 |

| Yes |

| None |

| BPC, DAC, HRC, NCGC | 51 |

| 2019 |

| Yes |

| None |

| DAC, HRC, NCGC |

Peter S. Ho |

| 56 |

|

| 2009 |

| No |

| None |

| None | 58 |

| 2009 |

| No |

| None |

| None |

Michelle E. Hulst |

| 48 |

|

| 2019 |

| Yes |

| 1 |

| DAC, HRC, NCGC | 50 |

| 2019 |

| Yes |

| None |

| DAC, HRC, NCGC |

Kent T. Lucien |

| 68 |

|

| 2006 |

| No |

| 1 |

| BPC, DAC, FIMC | 70 |

| 2006 |

| Yes |

| None |

| ARC, BSC, DAC, FIMC, NCGC |

Elliot K. Mills |

| 52 |

|

| 2021 |

| Yes |

| None |

| DAC, HRC, NCGC | 54 |

| 2021 |

| Yes |

| None |

| DAC, HRC, NCGC |

Alicia E. Moy |

| 44 |

|

| 2017 |

| Yes |

| 1 |

| ARC, FIMC, NCGC | 46 |

| 2017 |

| Yes |

| 1 |

| ARC, BSC, FIMC, NCGC |

Victor K. Nichols |

| 65 |

|

| 2014 |

| Yes |

| 2 |

| ARC, DAC, NCGC | 67 |

| 2014 |

| Yes |

| 2 |

| ARC, BSC, DAC, NCGC |

Barbara J. Tanabe |

| 72 |

|

| 2004 |

| Yes |

| None |

| ARC, FIMC, HRC, NCGC | |||||||||

Dana M. Tokioka |

| 51 |

|

| 2020 |

| Yes |

| None |

| DAC, FIMC | 53 |

| 2020 |

| Yes |

| None |

| DAC, FIMC |

Raymond P. Vara, Jr. |

| 52 |

|

| 2013 |

| Yes |

| None |

| ARC, HRC, NCGC | 54 |

| 2013 |

| Yes |

| None |

| ARC, BSC, HRC, NCGC |

Suzanne P. Vares-Lum | 56 |

| 2023 |

| Yes |

| None |

| FIMC, NCGC | |||||||||||

Robert W. Wo |

| 69 |

|

| 2002 |

| Yes |

| None |

| FIMC, HRC, NCGC | 71 |

| 2002 |

| Yes |

| None |

| FIMC, HRC, NCGC |

ARC - Audit & Risk Committee

BPCBSC - Benefit PlansBalance Sheet Committee

DAC - Digital Advisory Committee

FIMC - Fiduciary & Investment Management Committee

HRC - Human Resources & Compensation Committee

NCGC - Nominating & Corporate Governance Committee

6

As one of the largest financial institutions in Hawaii,Hawai‘i, finding director candidates with a deep knowledge of the focused market in which we operate is critical. The nominees'nominees’ breadth and diversity of experience, mix of qualifications, attributes, and skills strengthen our Board of Director'sDirector’s effective oversight of the Company'sCompany’s business. While our longer tenured directors bring a wealth of experience and deep understanding of the business, we recognize the need for fresh perspectives, have consistently added new directors, and are committed to continued board and committee diversity and refreshment.

6

ATTRIBUTES AND SKILLS OF THE NOMINEES

Nominees for directors are selected based on, among other criteria, their integrity, informed judgment, financial literacy, high performance standards, accomplishments and reputation in the community, experience, skill sets, ability to commit adequate time to Board and committee matters, and to act on behalf of shareholders. The criteria also includes a determination of the needs of the Board and of the individual’s personal qualities and characteristics with those of the other directors and potential directors in building a Board that is effective, collegial and responsive to the needs of the Company and its shareholders. The composition of the Board should encompass a broad range of skills, expertise, industry knowledge, diversity of background and viewpoint, and professional and community contacts relevant to the Company’s business.

12 Director Nominees: | Erickson | Feldman | Ho | Hulst | Lucien | Mills | Moy | Nichols | Tokioka | Vara | Vares-Lum | Wo |

Experience and Skills | ||||||||||||

Finance | ü |

| ü |

| ü | ü | ü | ü | ü | ü |

|

|

Banking | ü |

| ü |

| ü |

|

| ü |

|

|

|

|

Technology |

|

|

| ü |

|

|

| ü | ü |

|

|

|

Retail |

| ü |

|

|

| ü |

| ü |

|

| ü | |

Tourism |

|

|

|

|

| ü |

|

|

|

|

|

|

Marketing/Communications |

|

|

| ü |

|

|

| ü |

|

| ü |

|

International Experience | ü | ü | ü | ü |

|

| ü | ü |

|

| ü | ü |

Health |

|

|

|

|

|

|

|

|

| ü |

|

|

Education |

|

|

|

|

| ü |

| ü |

|

| ü |

|

Community | ü | ü |

| ü | ü | ü | ü | ü | ü | ü | ü | |

Hawai'i Market |

| ü | ü |

| ü | ü | ü |

| ü | ü | ü | ü |

Human Resources |

|

|

|

|

|

|

| ü |

|

|

|

|

Government Experience |

|

|

|

|

|

|

|

|

| ü | ü |

|

Energy |

|

|

|

|

| ü |

|

|

|

|

| |

Risk Management | ü |

|

|

|

| ü |

| ü | ü | ü | ü |

|

CEO Experience | ü | ü |

| ü |

| ü | ü |

| ü | ü | ü | |

Background | ||||||||||||

Gender |

|

|

|

| ||||||||

Male | ü | ü | ü |

| ü | ü |

| ü |

| ü |

| ü |

Female |

|

|

| ü |

|

| ü |

| ü |

| ü |

|

Non-binary |

|

|

|

|

|

|

|

|

|

|

|

|

Race |

|

|

|

| ||||||||

American Indian or Alaskan Native |

|

|

|

|

|

|

|

|

|

|

|

|

Asian |

|

| ü |

|

|

| ü |

| ü |

| ü | ü |

Black or African American |

|

|

|

|

|

|

|

|

|

|

|

|

Hispanic or Latinx |

|

|

|

|

|

|

|

|

|

|

|

|

Native Hawaiian or Pacific Islander |

|

|

|

|

| ü |

|

|

|

| ü |

|

White | ü | ü |

| ü | ü |

| ü | ü | ü | ü | ü |

|

Age/Tenure |

|

|

|

| ||||||||

Age | 62 | 51 | 58 | 50 | 70 | 54 | 46 | 67 | 53 | 54 | 56 | 71 |

Years on the Board | 4 | 4 | 14 | 4 | 17 | 2 | 6 | 9 | 3 | 10 | <1 | 21 |

Board Diversity & Skills | ||||

11 | 6 | 4 | 6 | 4 |

Experience with unique Hawaii marketplace | Independent directors with financial expertise | Significant international experience | Banking experience | Other public company board experience |

2 | 1 | 3 | 5 | 7 |

Media expertise | Background in public policy | Technology experience | Female directors | Native Hawaiian and/or Asian ancestry |

7

QUALIFICATIONS AND EXPERIENCE

|

| Qualifications |

John C. Erickson |

|

7

QUALIFICATIONS AND EXPERIENCE

|

| |

| Key Experience and Qualifications | |

• | ||

| ||

| ||

| ||

| ||

| ||

| ||

|

| |

| ||

| ||

| ||

| ||

| ||

| ||

|

8

|

| |

|

| |

| ||

Career Highlights | ||

| ||

• Mr. Erickson began his career at Union Bank in 1983 and served in various leadership roles including Vice Chairman, Chief Corporate Banking Officer responsible for Commercial Banking, Real Estate Industries, Global Treasury Management, Global Capital Markets, and Wealth Management, and as Vice Chairman and Chief Risk Officer responsible for enterprise-wide risk management and regulatory relations. | ||

Other Professional Experience and Community Involvement | ||

• Mr. Erickson served on the boards of the California Bankers Association, The Living Desert as a member of the Finance and Long Range Planning Committees, and The Music Center as its Treasurer and • Mr. Erickson was a member of the Audit Committee Roundtable of Orange County, the Financial Services Board Roundtable, and the American Bankers Association Bankers Council. | ||

Education | ||

| ||

• Mr. Erickson received his bachelor’s degree with an emphasis in economics, and his M.B.A. with an emphasis in finance from the University of Southern California. | ||

Joshua D. Feldman | Key Experience and Qualifications | |

• Mr. Feldman is President and CEO of Tori Richard, Ltd., founded in 1956. Tori Richard, Ltd. is a Honolulu-based manufacturer, wholesaler and retailer of branded resort apparel, licensed apparel products, private label clothing and uniforms. He began his career in 1994 and was appointed President and CEO in 2004. Mr. Feldman has a solid understanding of the | ||

Career Highlights | ||

| ||

• Under his leadership, Mr. Feldman created Tori Richard’s retail division, TR Retail LLC, relaunched the • Tori Richard, Ltd. and subsidiary branded and private label products are sold in over 1,500 specialty and department store locations throughout the world. The company operates 21 company-owned stores in the state of Hawai‘i. | ||

Other Professional Experience and Community Involvement | ||

• Mr. Feldman is committed to the community, having served on the boards of • He currently serves | ||

Education | ||

| ||

• Mr. Feldman graduated magna cum laude with a bachelor’s degree from the University of California, San Diego. |

8

9

Name | Qualifications | |

Peter S. Ho | Key Experience and Qualifications | |

• As Chairman and CEO, Mr. Ho remains focused on the Bank’s longstanding strategy • Under Mr. Ho’s leadership, Bank of | ||

Career Highlights | ||

| ||

• Mr. Ho has served as Chairman and CEO of the Company since July 2010; President since April 2008; Vice Chair and Chief Banking Officer from January 2006-April 2008; Vice Chair, Investment Services Group from April 2004-December 2005; and Executive Vice President, • In 2018, Mr. Ho completed his second three-year term on the board of the Federal Reserve Bank of San Francisco. | ||

Other Professional Experience and Community Involvement | ||

• Mr. Ho served as Chairman of the 2011 Asia Pacific Economic Cooperation • Mr. Ho currently serves as vice chairman of the State of • Mr. Ho is active in the | ||

Education | ||

| ||

• Mr. Ho holds a bachelor of science degree in business administration and an M.B.A. from the University of Southern California. He is also a 2008 graduate of Harvard Business School’s Advanced Management Program. |

9

10

Name | Qualifications | |

Michelle E. Hulst | Key Experience and Qualifications | |

• Ms. Hulst • Ms. Hulst served as Executive Vice President, Global Data & Strategy, Chief Operating Officer and Chief Data Officer at The Trade Desk, company’s rapid geographic expansion. • Ms. Hulst | ||

Career Highlights | ||

| ||

• Prior to Oracle Data Cloud, Ms. Hulst worked at Datalogix Inc., from 2006 to 2015, where she served as Senior Vice President of Strategic Partnerships and Business Development. During her tenure at Datalogix, Inc., she led the global deal team’s execution of pivotal partnerships with companies such as Facebook, Twitter, and Google, which were instrumental in the transformation of the business. She also was a member of the executive team that led the sale of Datalogix to Oracle. | ||

Other Professional Experience and Community Involvement | ||

• Ms. Hulst also worked at Entertainment Publications, an operating business of IAC/InterActiveCorp, where she held several positions, including Vice | ||

Education | ||

| ||

• Ms. Hulst earned a bachelor’s degree in organizational psychology from the University of Michigan and her M.B.A., with an emphasis in strategy, marketing and entrepreneurship, from Northwestern University’s Kellogg School of Management. | ||

Kent T. Lucien | Key Experience and Qualifications | |

• Mr. Lucien’s senior executive experience in major • Mr. Lucien was elected to the Board in 2006 and served as Chair of the Audit & Risk Committee prior to becoming the Company’s Chief Financial Officer in 2008. | ||

Career Highlights | ||

| ||

• Mr. Lucien served as Vice Chair and Chief Strategy Officer from March 2017 to April 2020 and executed the Bank’s key strategic initiatives, including the “Branch of Tomorrow” modernization project and leveraging information and technology to reshape the delivery of banking services, products and experiences with a customer focus. • Mr. Lucien served as Vice Chair and Chief Financial Officer of the Company from April 2008 to February 2017. | ||

Other Professional Experience and Community Involvement | ||

• Prior to his employment with the Company, Mr. Lucien served as a Trustee for C. Brewer & Co. Ltd., (a • He also worked for Pricewaterhouse Coopers and is a Certified Public Accountant (inactive). • He served on the board of Wailuku Water Company LLC. | ||

Education | ||

| ||

• Mr. Lucien received his bachelor’s degree from Occidental College and his M.B.A. from Stanford University. |

10

11

Name | Qualifications | |

Elliot K. Mills | Key Experience and Qualifications | |

• Mr. Mills brings an abundance of expertise and insight of | ||

Career Highlights | ||

| ||

• Mr. Millsserves as Vice President of Hotel Operations for Disneyland Resort and Aulani, A Disney Resort and Spa. Mr. Mills is responsible for overseeing all operations for the Disneyland Hotel, Disney’s Paradise Pier Hotel and Disney’s Grand Californian Hotel & Spa in Anaheim, California, and Aulani, A Disney Resort & Spa, in Ko Olina on O‘ahu. • Mr. Mills had a special focus on advancing Hawaiian culture and values as the focal point for Aulani’s unique hospitality and service experience. | ||

Other Professional Experience and Community Involvement | ||

• Mr. Mills has held various executive and resort management positions on the islands of • Mr. Mills serves on a variety of boards, including | ||

Education | ||

| ||

• Mr. Mills holds a degree in business administration with an emphasis in travel industry management from the University of Hawai‘i at Mānoa, and has completed the Cornell Hospitality Management General Managers Program. | ||

Alicia E. Moy | Key Experience and Qualifications | |

• Ms. Moy’s expertise in utilities and energy has given her a unique and holistic perspective on the integrated nature of | ||

Career Highlights | ||

| ||

• Ms. Moy has been President and Chief Executive Officer of Hawai‘i Gas since May 2013, which is the state’s only government-franchised, full-service gas company. Hawai‘i. • From 2001 to 2013, Ms. Moy was Senior Vice President with Macquarie Infrastructure and Real Assets (“MIRA”), where she oversaw corporate strategy, strategic planning, funding and management of several MIRA-managed utility companies, including Hawai‘i Gas. | ||

Other Professional Experience and Community Involvement | ||

• Ms. Moy has served as a member of Hawai‘i Gas’s board of directors since 2011. From 1999-2001, Ms. Moy worked for Morgan Stanley in the Investment Banking division, where she was involved in corporate finance and mergers and acquisitions for private equity clients. •

Ms. Moy is a member of the Hawaii Business Roundtable and the Military Affairs Council. She serves on the boards of the | ||

Education | ||

| ||

• Ms. Moy holds a bachelor’s degree in finance and marketing from the University of Miami and a master’s degree in finance from INSEAD. |

11

12

Name | Qualifications | |

Victor K. Nichols | Key Experience and Qualifications | |

• Mr. Nichols’s over 40 years of executive leadership experience and knowledge in both information technology and the financial services industry, as well as his background and expertise in marketing, data analytics and strategic planning, add a valuable global perspective to the Board in understanding the increasingly important role information technology has in the financial services industry. Mr. Nichols’s background, | ||

Career Highlights | ||

| ||

• Mr. Nichols is the Chairman of Make-A-Wish, International, a not-for-profit foundation providing life changing wishes to ill children in 50 countries outside of the U.S., and has held that position since November 2022. • Mr. Nichols served as an independent advisor to Harland Clarke • Mr. Nichols previously served as Chief Executive Officer of North America, Managing Director of EMEA, and President of Global Consumer Services for Experian, the leading global information services company providing data and analytical tools to clients around the world. • Prior to joining Experian, • Mr. Nichols • Mr. Nichols was past President and founding partner of VICOR, Inc., an advanced technology engineering firm leading business transformation with a concentration in the financial services | ||

Other Professional Experience and Community Involvement | ||

• Mr. Nichols • In addition, | ||

Education | ||

| ||

• Mr. Nichols holds a bachelor of science degree in economics from the University of California, San Diego, and an M.B.A. in finance from the University of California, Berkeley. |

13

12

Name | Qualifications | |

| Key Experience and Qualifications | |

• | ||

| ||

| ||

| ||

| ||

| ||

| ||

|

| |

| ||

Career Highlights | ||

| ||

• Ms. Tokioka serves as Vice President of Special • Prior to Atlas Insurance, Ms. Tokioka practiced both real estate and corporate law in California, representing numerous technology companies and performing due diligence for financings and M&A transactions. She negotiated terms and conditions for software, hardware, and consulting agreements and for strategic alliances with U.S. and international corporations. Ms. Tokioka also worked for Booz Allen Hamilton as an Economic Business Analyst to perform economic and cost analysis for IT systems as well as strategize financial and programmatic assessments for the U.S. Army. | ||

Other Professional Experience and Community Involvement | ||

• Ms. Tokioka was a member of the Board of Directors of Tradewind Capital Group, a • Ms. Tokioka is a dedicated supporter of the | ||

Education | ||

| ||

• Ms. Tokioka is a graduate of Tufts University with a bachelor of arts degree, cum laude, in history. She received her M.B.A. from the McDonough School of Business at Georgetown University and her Juris Doctor from the Georgetown University Law Center. |

13

14

Name | Qualifications | |

Raymond P. Vara, Jr. | Key Experience and Qualifications | |

• Mr. Vara’s financial and operational background coupled with his senior executive and audit committee experience make him qualified to serve on the Company’s Board. His community involvement and leadership of | ||

Career Highlights | ||

| ||

• Mr. Vara was named Hawaii Business Magazine CEO of the Year 2021. • As President and CEO of • Prior to his appointment to CEO in 2012, • Mr. Vara also served as Chief Financial Officer and Chief Executive Officer for Los Alamos Medical Center in New Mexico, an integrated health care service provider. | ||

Other Professional Experience and Community Involvement | ||

• Prior to joining the private sector, Mr. Vara held various positions in the United States Army, including Controller for the Army’s Northwestern Healthcare Network, Deputy Chief Financial Officer of the Madigan Army Medical Center in Tacoma, Washington, and Assistant Administrator and Chief Financial Officer of Bassett Army Community Hospital in Fairbanks, Alaska. • Mr. Vara is active in the | ||

Education | ||

| ||

• Mr. Vara holds a bachelor’s degree in business administration from |

14

Name | Qualifications | |

| Key Experience and Qualifications | |

• Ms. Vares-Lum is a retired Major General in the U.S. Army. She joined the Board in 2023, and her decades of executive leadership and planning experience qualify her to serve on our Board. | ||

Career Highlights | ||

• Ms. Vares-Lum has served as President of the East-West Center since January 2022. She is the first woman and Native Hawaiian to be chosen for this role since the Center’s establishment in 1960. In 2022, she launched a new strategic plan that advances the Center’s mission to promote understanding and relationships among people and nations of the U.S., Asia and Pacific through cooperative study, research and dialogue. • Ms. Vares-Lum formed Vares-Lum Indo-Pacific Consulting, LLC to provide consulting and advising on regional issues. She is an advocate for education and building bridges across the Indo-Pacific, and has led collaborative initiatives in the region. • As a retired Major General with 34 years of service, Ms. Vares-Lum has held key roles addressing priority national security challenges in the region, with over five years serving with and advising the most senior officials at U.S. Indo-Pacific Command, where she cultivated and maintained key relationships with nations throughout the Indo-Pacific region. | ||

Other Professional Experience and Community Involvement | ||

• As a community leader, Ms. Vares-Lum serves on a variety of nonprofit boards, including the American Red Cross Pacific Islands Region, Pacific and Asian Affairs Council, and the Pacific International Center for High Technology Research. • Ms. Vares-Lum is a current member of the U.S.-Japan Council and has also served on committees that promote Hawai‘i’s economic diversification, workforce development, and community dialogue on issues regarding land and water. • In addition to her military and community awards, she is the recipient of the 2023 Girl Scouts of Hawai‘i Women of Distinction Award, and a 2017 Ellis Island Medal of Honor Awardee. | ||

Education | ||

• Ms. Vares-Lum received her Bachelor of Arts degree in Journalism in 1989 and her Master of Education in Teaching in 1996 from the University of Hawai‘i at Mānoa. As a graduate of the U.S. Army War College, she earned a Master of Strategic Studies degree in 2011. In 2019, she became a National Security Fellow of the Maxwell School of Citizenship and Public Affairs at Syracuse University. She is also an alumna of the Daniel K. Inouye Asia-Pacific Center for Security Studies. | ||

Robert W. Wo | Key Experience and Qualifications | |

• As Owner and Director of C.S. Wo & Sons, Ltd. | ||

Career Highlights | ||

| ||

• Mr. Wo has been the Owner and Director of C.S. Wo & Sons, Ltd. since 1984. | ||

Other Professional Experience and Community Involvement | ||

• Mr. Wo is active in the community, having served on the boards of Aloha United Way, Junior Achievement of Hawaii, • Mr. Wo is a past member of the Hawaii Business Roundtable whose mission is to promote the overall economic vitality and social health of | ||

Education | ||

| ||

• Mr. Wo received his bachelor’s degree in economics from Stanford University and earned his M.B.A. from Harvard Business School. |

15

15

At the close of business on January 31, 2022,2024, Bank of HawaiiHawai‘i Corporation had 40,378,16539,821,950 shares of its common stock outstanding. As of January 31, 2022,2024, the following table shows the amount of Bank of HawaiiHawai‘i Corporation common stock owned by (i) each person or entity who is known by us to beneficially own more than five percent of Bank of HawaiiHawai‘i Corporation’s common stock; (ii) each current director and director nominee, (iii) each of the executive officers named in the Summary Compensation Table (the “named executive officers”), and (iv) all of our directors and executive officers as a group. Unless otherwise indicated and subject to applicable community property and similar statutes, all persons listed below have sole voting and investment power over all shares of common stock beneficially owned. Share ownership has been computed in accordance with SEC rules and does not necessarily indicate beneficial ownership for any other purpose.

Name | Number of |

| Right to |

| Total |

| Percent of |

| |

More than Five Percent Beneficial Ownership |

|

|

|

|

|

|

|

|

|

BlackRock, Inc. | 5,742,226 | (1) |

| — |

| 5,742,226 |

| 14.40% |

|

The Vanguard Group | 4,650,102 | (2) |

| — |

| 4,650,102 |

| 11.70% |

|

State Street Corporation | 2,363,909 | (3) |

| — |

| 2,363,909 |

| 5.95% |

|

Kayne Anderson Rudnick Investment Management LLC | 2,056,495 | (4) |

| — |

| 2,056,495 |

| 5.17% |

|

|

|

|

|

|

|

|

|

|

|

Current Directors and Director Nominees |

|

|

|

|

|

|

|

|

|

S. Haunani Apoliona | 38,572 | (5) |

| — |

| 38,572 |

| * |

|

Mark A. Burak | 13,701 | (5) |

| — |

| 13,701 |

| * |

|

John C. Erickson | 8,382 | (5)(6) |

| — |

| 8,382 |

| * |

|

Joshua D. Feldman | 5,987 | (5) |

| — |

| 5,987 |

| * |

|

Michelle E. Hulst | 4,586 | (5) |

| — |

| 4,586 |

| * |

|

Kent T. Lucien | 42,030 | (5)(6)(7) |

| — |

| 42,030 |

| * |

|

Elliot K. Mills | 3,180 | (5) |

| — |

| 3,180 |

| * |

|

Alicia E. Moy | 10,482 | (5) |

| — |

| 10,482 |

| * |

|

Victor K. Nichols | 28,124 | (5) |

| — |

| 28,124 |

| * |

|

Barbara J. Tanabe | 34,088 | (5) |

| — |

| 34,088 |

| * |

|

Dana M. Tokioka | 4,410 | (5) |

| — |

| 4,410 |

| * |

|

Raymond P. Vara, Jr. | 9,878 | (5) |

| — |

| 9,878 |

| * |

|

Suzanne P. Vares-Lum | 1,525 | (5) |

|

|

| 1,525 |

| * |

|

Robert W. Wo | 82,890 | (5)(6) |

| — |

| 82,890 |

| * |

|

|

|

|

|

|

|

|

|

|

|

Named Executive Officers |

|

|

|

|

|

|

|

|

|

Peter S. Ho (also Director Nominee) | 290,994 |

|

| — |

| 290,994 |

| * |

|

Dean Y. Shigemura | 70,945 | (6) |

| — |

| 70,945 |

| * |

|

Marco A. Abbruzzese | 13,735 |

|

| — |

| 13,735 |

| * |

|

Matthew K.M. Emerson | 23,572 |

|

| — |

| 23,572 |

| * |

|

S. Bradley Shairson | 29,291 |

|

| — |

| 29,291 |

| * |

|

All current directors, director nominees, and executive officers as a group (24 persons) | 983,032 |

|

| — |

| 983,032 |

| 2.47% |

|

* Each of the current directors, director nominees, and named executive officers beneficially owned less than one percent of Bank of | |||||||||

Name |

| Number of Shares Beneficially Owned |

| Right to Acquire Within 60 Days |

|

| Total |

|

| Percent of Outstanding Shares as of January 31, 2022 |

|

| ||||||

More than Five Percent Beneficial Ownership |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Vanguard Group 100 Vanguard Blvd. Malvern, Pennsylvania 19355 |

|

| 3,841,480 |

| (1) |

|

| — |

|

|

| 3,841,480 |

|

|

| 9.55 | % |

|

BlackRock, Inc. 55 East 52nd Street New York, New York 10055 |

|

| 3,801,808 |

| (2) |

|

| — |

|

|

| 3,801,808 |

|

|

| 9.40 | % |

|

Kayne Anderson Rudnick Investment Management LLC 1800 Avenue of the Stars, 2nd Floor, Los Angeles, California 90067 |

|

| 2,714,193 |

| (3) |

|

|

|

|

|

| 2,714,193 |

|

|

| 6.71 | % |

|

Neuberger Berman Group LLC 1290 Avenue of the Americas New York, New York 10104 |

|

| 2,602,515 |

| (4) |

|

| — |

|

|

| 2,602,515 |

|

|

| 6.47 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Directors and Director Nominees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S. Haunani Apoliona |

|

| 32,889 |

| (5) |

|

| — |

|

|

| 32,889 |

|

| * |

|

| |

Mark A. Burak |

|

| 11,484 |

| (5) |

|

| — |

|

|

| 11,484 |

|

| * |

|

| |

John C. Erickson |

|

| 6,165 |

| (5)(6) |

|

| — |

|

|

| 6,165 |

|

| * |

|

| |

Joshua D. Feldman |

|

| 3,770 |

| (5) |

|

| — |

|

|

| 3,770 |

|

| * |

|

| |

Michelle E. Hulst |

|

| 2,369 |

| (5) |

|

| — |

|

|

| 2,369 |

|

| * |

|

| |

Kent T. Lucien |

|

| 38,813 |

| (6)(7) |

|

| — |

|

|

| 38,813 |

|

| * |

|

| |

Elliot K. Mills |

|

| 376 |

| (5) |

|

| — |

|

|

| 376 |

|

| * |

|

| |

Alicia E. Moy |

|

| 4,065 |

| (5) |

|

| — |

|

|

| 4,065 |

|

| * |

|

| |

Victor K. Nichols |

|

| 19,465 |

| (5) |

|

| — |

|

|

| 19,465 |

|

| * |

|

| |

Barbara J. Tanabe |

|

| 28,186 |

| (5) |

|

| — |

|

|

| 28,186 |

|

| * |

|

| |

Dana M. Tokioka |

|

| 2,193 |

| (5) |

|

| — |

|

|

| 2,193 |

|

| * |

|

| |

Raymond P. Vara, Jr. |

|

| 7,661 |

| (5) |

|

| — |

|

|

| 7,661 |

|

| * |

|

| |

Robert W. Wo |

|

| 68,386 |

| (5)(6) |

|

| — |

|

|

| 68,386 |

|

| * |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Named Executive Officers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Peter S. Ho (also Director Nominee) |

|

| 242,452 |

|

|

|

| — |

|

|

| 242,452 |

|

| * |

|

| |

Dean Y. Shigemura |

|

| 62,977 |

| (6) |

|

| — |

|

|

| 62,977 |

|

| * |

|

| |

Sharon M. Crofts |

|

| 69,666 |

|

|

|

| — |

|

|

| 69,666 |

|

| * |

|

| |

James C. Polk |

|

| 103,442 |

| (6) |

|

| — |

|

|

| 103,442 |

|

| * |

|

| |

Mary E. Sellers |

|

| 97,206 |

| (6) |

|

| — |

|

|

| 97,206 |

|

| * |

|

| |

All current directors, director nominees, and executive officers as a group (21 persons) |

|

| 833,541 |

|

|

|

| — |

|

|

| 833,541 |

|

|

| 2.06 | % |

|

* Each of the current directors, director nominees, and named executive officers beneficially owned less than one percent of Bank of Hawaii Corporation's outstanding common stock as of January 31, 2022. | ||||||||||||||||||

16

|

|

16

|

|

|

|

|

|

17 |

|

|

|

|

|

17

SOUND ENVIRONMENTAL, SOCIAL, AND GOVERNANCE LEADERSHIP

The Company is dedicated to making corporate social responsibility a part of everything we do in the communities we serve—serve, including how we manage and develop our people, the products and services we offer, and the investments we make in creating a sustainable and resilient economy in our communities. The Bank’s commitment to integrity and ethical excellence drives itsCompany’s Environmental, Social and Governance (“ESG”) strategy. The Company’s senior management team develops the Company’s ESG strategic direction andCommittee is driving progress through an internal ESG working group led by a cross-functional team of senior executives representing Corporate Communications, Community & Employee Engagement, Philanthropy, Real Estate & Facilities, Human Resources,Banking, People Services, Investor Relations, Legal, Risk and Legal. Our Board is charged with providing guidance, insightVendor Management, and oversight asall aspects of our revenue generating businesses. The ESG Committee reports to the strategy, initiativesNominating and management’s performance in achieving ESG goals.Corporate Governance Committee of the Board. Senior management and the Board remain committed to being a leader among Hawaii’sHawai‘i’s corporate citizens by fostering an effective and efficient risk and control environment that includes an emphasis on an ethically driven culture, sustainable growth, and an ongoing investment in our employees and our community. The Company publishes an annual ESG Report, which adheres to the Sustainability Accounting Standards Board (“SASB”) framework.

The Company’s Code of Business Conduct and Ethics drives a workplace and workforce that embraces the highest ethical and moral standards. We maintain strong and confidential reporting processes and procedures that support an open and honest environment in an effort to ensure that the highest principles of integrity and inclusion are maintained.

The Company believes that a diverse and inclusive workforce fosters an environment where everyone can thrive and be successful. As of December 31, 2021,2023, approximately 87% of the Company’s workforce are minoritiesethnically diverse (non-Caucasian) and approximately 63% are female, including 45%43% and 56%60% of our senior leaders and managers, respectively. In addition, we conduct an external pay equity study periodically to ensure that a gender pay gap does not exist.

COMMITMENT TO EFFECTIVE CORPORATE GOVERNANCE

The Company is committed to effective corporate governance practices that enhance and protect shareholder rights including:rights. As of December 31, 2023, the following corporate governance practices were in place:

Annually elected directors

Majority voting in director elections with a plurality carve out in the case of contested elections and a director resignation policy

Independent directors comprise 86% (12)93% (14) of the Board and 100% of key committees

36%40% of directors are women (5)

50%53% of directors are ethnically diverse (7)

Ongoing director refreshment with 6 new directors added in the past 5 years

The directors are subject to Company stock ownership guidelines equal to 5 times the director annual cash retainer

Directors actively participate in continuing education programs on corporate governance and related issues

Each director attended at least 75% of the Board and the director’s assigned committee meetings

The Company has adopted an annual frequency for the Say-on-Pay vote

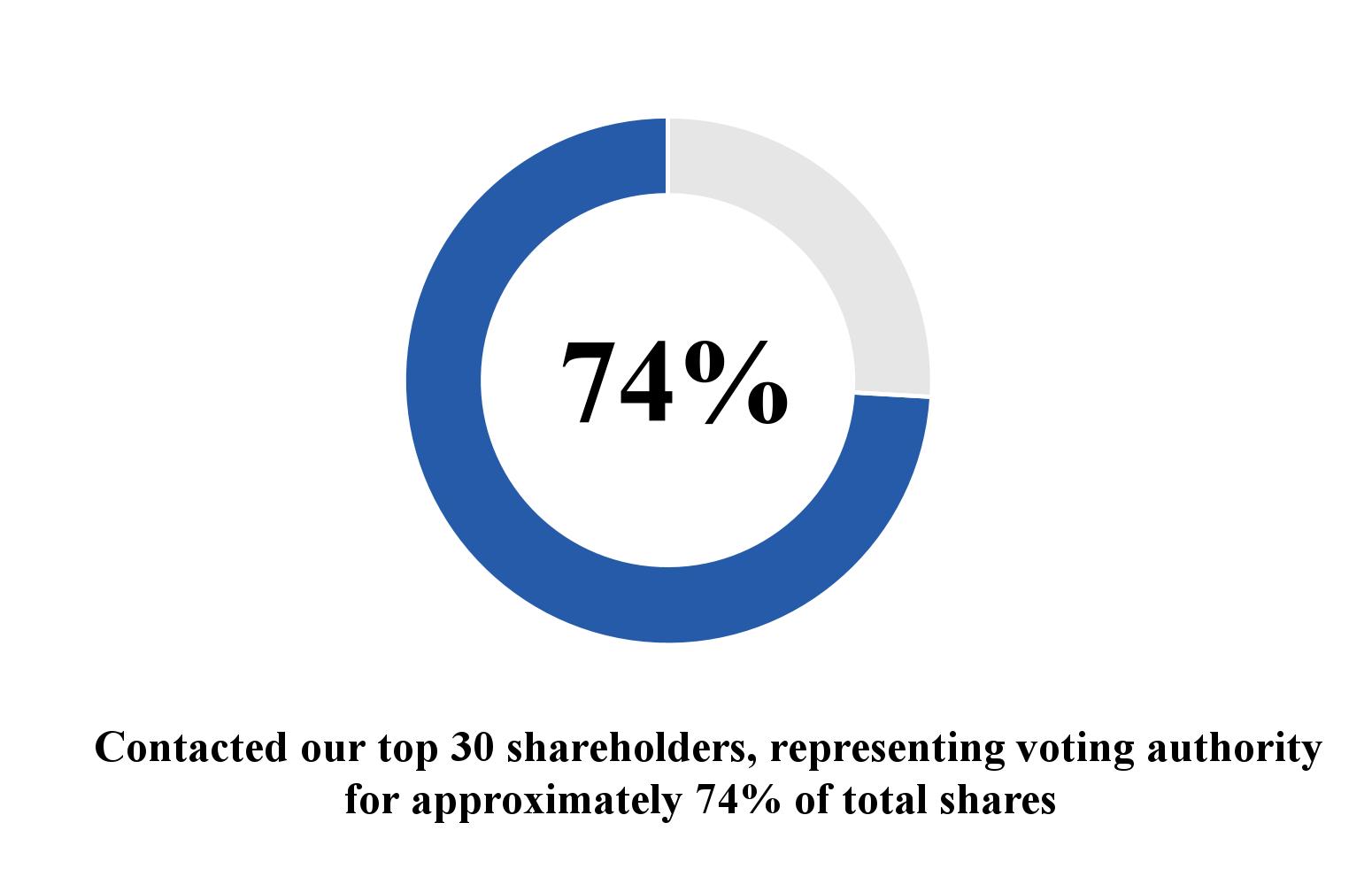

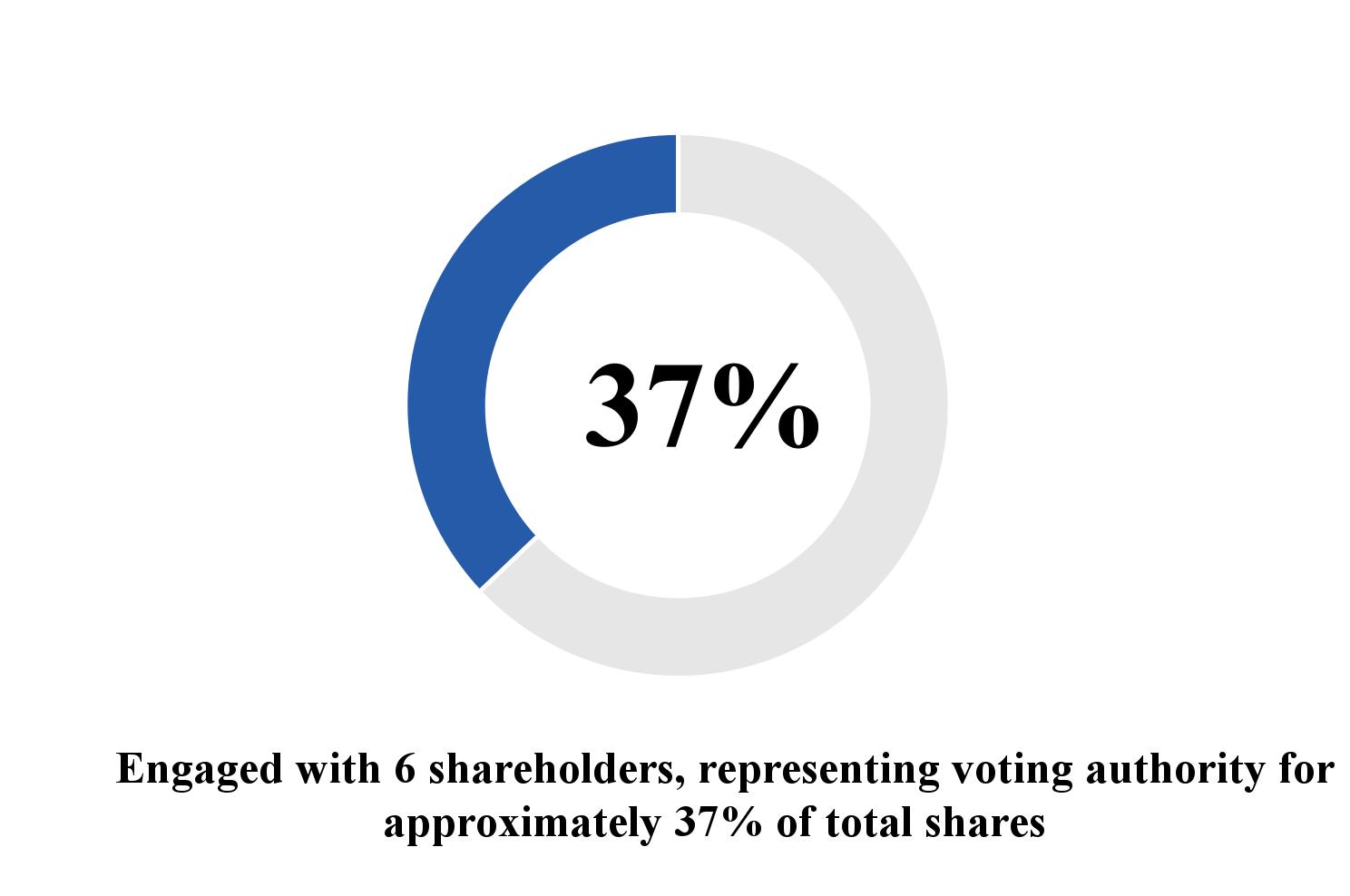

The Company participates in robust shareholder outreach activities

The Company supports a whistleblower policy and program

The Company maintains a clawback policy

No poison pill has been adopted

18

Corporate Governance Guidelines

The Company and the Board have adopted Corporate Governance Guidelines (“Governance Guidelines”). The Governance Guidelines are posted on the Investor Relations page of the Company’s website at www.boh.com. The Governance Guidelines address director qualification and independence standards, responsibilities of the Board, access to management and access to independent advisors, compensation, orientation and continuing education, Board committees, Chief Executive Officer (“CEO”) evaluation, management succession, Code of Business Conduct and Ethics, shareholder communications to the Board and the Board’s annual performance evaluation.

The Company’s leadership structure includes both a combined Chairman and CEO and a separate Lead Independent Director. At this time, the Board believes that it is in the best interests of the Company to have a single individual serve as Chairman and CEO to control and implement the short- and long-term strategies of the Company. The Board believes that this joint position provides it with the ability to perform its oversight role over management with the benefit of a management perspective as to the Company’s business strategy and all other aspects of the business. With its Lead Independent Director, this governance structure also provides a form of leadership that allows the Board to function distinct from management, capable of objective judgment regarding management’s performance, and enables

18

the Board to fulfill its duties effectively and efficiently. The Company’s leadership structure promotes the objectivity of the Board’s decisions and its role in reviewing the performance of management. Through its leadership and governance processes the Company seeks to establish a governance structure that provides both oversight and guidance by the Board to management regarding strategic planning, risk assessment and management, and corporate performance.

The Company’s Lead Independent Director is appointed by the Board and the current Lead Independent Director, Mr. Raymond P. Vara, Jr., was appointed in April 2020. The Company’s Governance Guidelines clearly define the Lead Independent Director’s role and duties which include, but are not limited to, serving as ChairmanChair of the Company’s Nominating & Corporate Governance Committee, presiding over regularly scheduled executive sessions of the non-management directors, serving as a liaison between the non-management directors and executive management, and assisting the Board and executive management to ensure compliance with the Governance Guidelines.

The Company’s Nominating & Corporate Governance CommitteeBoard has determined that 1211 of the 13 current11 non-management directors,director nominees for the 2024 Annual Meeting of Shareholders, including the Lead Independent Director, are “independent” as defined by the NYSE rules. The non-management directors meet in executive session without management in attendance for regularly scheduled meetings. The non-management directors may also meet in executive session each time the full Board convenes for a meeting. In 2021,2023, the non-management directors met threefive times in executive session. The Lead Independent Director also meets regularly on an individual basis with members of the Company’s executive management team.

Director Qualifications and Nomination Process

The Nominating & Corporate Governance Committee is responsible for identifying and assessing all director candidates and recommending nominees to the Board. Potential nominees are evaluated based on their independence, within the meaning of the Governance Guidelines and the rules of the NYSE. Candidates to be nominated as a director, including those submitted by shareholders, are selected based on, among other criteria, their integrity, informed judgment, financial literacy, high performance standards, accomplishments and reputation in the community, experience, skill sets, and ability to commit adequate time to Board and committee matters and to act on behalf of shareholders. The criteria also include a determination of the needs of the Board and of the interplay between each individual’s personal qualities and characteristics and those of the other directors and potential directors in building a Board that is effective, collegial and responsive to the needs of the Company and its shareholders. In addition, Board members are expected to participate in continuing education and training opportunities to stay current on corporate governance, industry trends and issues and to enhance their understanding of the Company’s business.

The objective of the Nominating & Corporate Governance Committee is to present a combination of candidates that will result in a Board with a wide range of skills, expertise, industry knowledge, viewpoints, and backgrounds, with business and community contacts relevant to the Company’s business. To accomplish this, the Nominating & Corporate Governance Committee seeks candidates from different age groups, ethnicities, genders, industries, and experiences, in addition to the criteria described above. The Board includes directors with experience in public corporations, nonprofit organizations, and entrepreneurial individuals who have successfully run their own private enterprises. The Board also has the broad set of skills necessary for providing oversight to a financial institution, which includes proven leadership and expertise in finance, accounting, information technology, risk management, lending, investment management, digital marketing, data analytics and communications. A shareholder may submit a candidate for consideration by the Board to be included in the Board’s slate of director nominees. Candidates proposed by shareholders will be evaluated by the Nominating & Corporate Governance Committee under the same criteria that are applied to other candidates. The criteria are set forth above and in the Company’s Bylaws and Governance Guidelines. Candidates to be considered for nomination by the Nominating & Corporate Governance Committee at the 20232024 Annual Meeting of Shareholders must behave been presented in writing to the Corporate Secretary on or before November 18, 2022,2023, at 130 Merchant Street, Honolulu, HawaiiHawai‘i 96813.

19

Director Experience, Tenure, Diversity and Refreshment

The Board maintains a unique balance of experience, tenure, diversity, cultural and local market knowledge and broad subject matter expertise. While our longer-tenured directors carry a wealth of experience and deep understanding of the Company and our industry, the Board embraces the need for fresh perspectives and is committed to continued director refreshment.

Since 2017,2019, the Board has added six new directors. In anticipationThree of the current directors will retire at the 2024 Annual Meeting due to reaching the mandatory retirement of three directors in 2024, on October 22, 2021 the Board increased the number of directors on the Board to 14 and elected new director Elliot K. Mills to serve until the 2022 Annual Meeting. On February 18, 2022, Mr. Millsage, and the otherremaining 12 current directors were nominated to stand for re-election at the 20222024 Annual Meeting.

The Board employs a balanced approach to populating Board Committees. This refreshment strategy results in a membership that maintains new and contemporary perspectives, ideas and approaches, with the appointment of Mmes. Moy and Tanabe to the Audit & Risk Committee in 2020.approaches.

19

Board and Committee Evaluations

The Nominating & Corporate Governance Committee leads and oversees the annual evaluation of the Board and Board committees. The annual evaluation includes an individual director self-assessment and an independent third party hosted survey to determine whether the Board and its committees are functioning effectively. The Nominating & Corporate Governance Committee establishes the evaluation criteria, oversees the evaluation process, discusses the results with the Board, and implements any changes that emerge from the evaluations that the Board deems appropriate to enhance Board effectiveness.

An independent consultant provides assistance with the design of the online survey instrument and administers the survey on behalf of the Nominating & Corporate Governance Committee, thereby assuring anonymity of participant responses through a secure, encrypted website. A written report of total sample data, as well as data for the Board committees, is prepared by the consultant, analyzing the closed-end questions and including the verbatim comments offered by directors at the close of each section of the survey that may provide recommendations for improvement. The report also tracks current data against results from previous surveys, where comparable. The Nominating & Corporate Governance Committee, through the same third party, distributes a survey to executive management for feedback concerning how the Board and its committees can enhance their effectiveness.

Majority Voting

The Company’s Bylaws and Governance Guidelines provide for majority voting in uncontested elections and a resignation process in the event a director nominee does not obtain a majority of votes cast. The resignation process provides the Board with discretion to accept or reject a tendered resignation if a majority vote is not obtained. If the tendered resignation is not accepted by the Board, the Board shall not nominate such director to stand for re-election at the next annual meeting of shareholders.

Communication with Directors

Shareholders and any interested parties may communicate with the Board, non-management directors, or the Lead Independent Director by sending correspondence c/o the Company’s Corporate Secretary, 130 Merchant Street, Honolulu, HawaiiHawai‘i 96813. All appropriate communications received will be forwarded to the Board, non-management directors or the Lead Independent Director as addressed.